Introduction

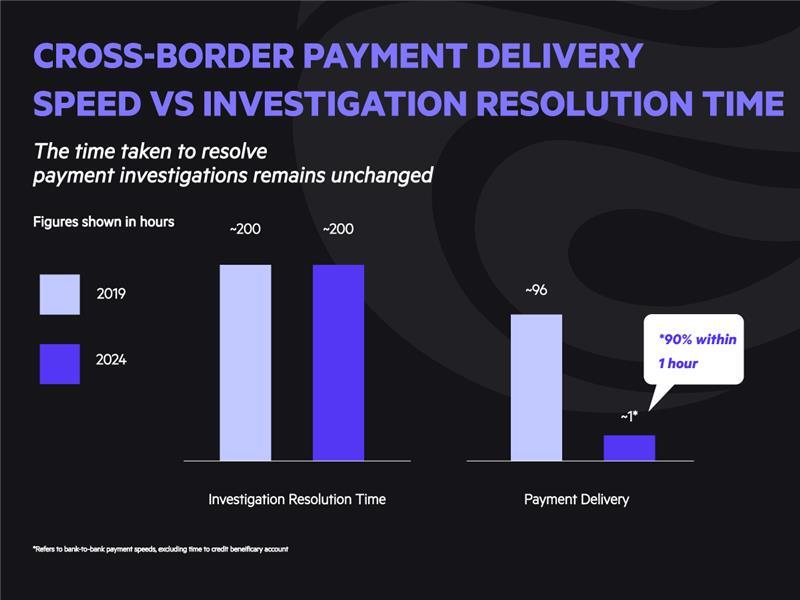

At Sibos 2025, the industry will celebrate how far payments modernization has come. Real time rails are live, and cross border payments now reach the end beneficiary bank in a day or less in most corridors. Yet one critical process has not kept pace: payment investigations.

Today, resolving an exception or inquiry typically spans five to ten days, while the actual handling effort is closer to ninety minutes. The problem is not only the work itself, but the wait. That gap between fast delivery to the beneficiary and slow resolution is a structural weakness in modern payments. It injects avoidable costs, frustrates corporates that expect timely answers, and increases regulatory and reputational exposure.

This article explores the missing middle: the space between Swift’s Case Management utility and enterprise scale solutions. It is the space where most bank offerings fall short.

The Weak Link in Payments Modernization

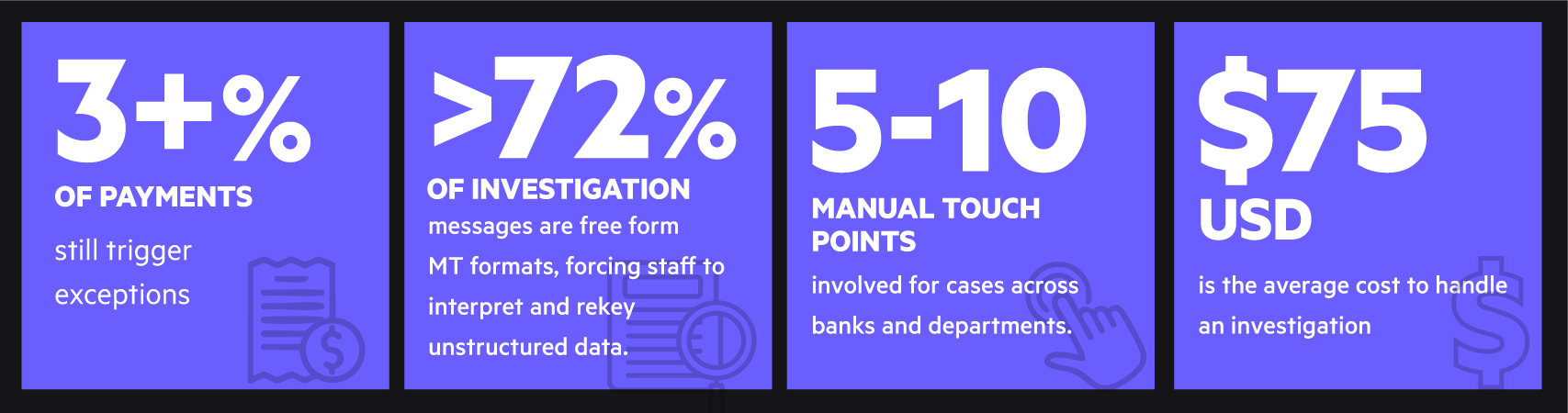

For all the progress in instant payments and ISO 20022, exceptions and investigations (E&I) remain the weakest link in the payment investigation process.

The result is slow and opaque investigations that damage customer trust. Swift research shows that poor E&I experiences drive three percent or more attrition among corporate clients. For large institutions, the costs can exceed twenty million dollars per year in fees, penalties, and operational drag. For mid-tier banks, without the scale or budgets of their global peers, these same pain points cut deeper.

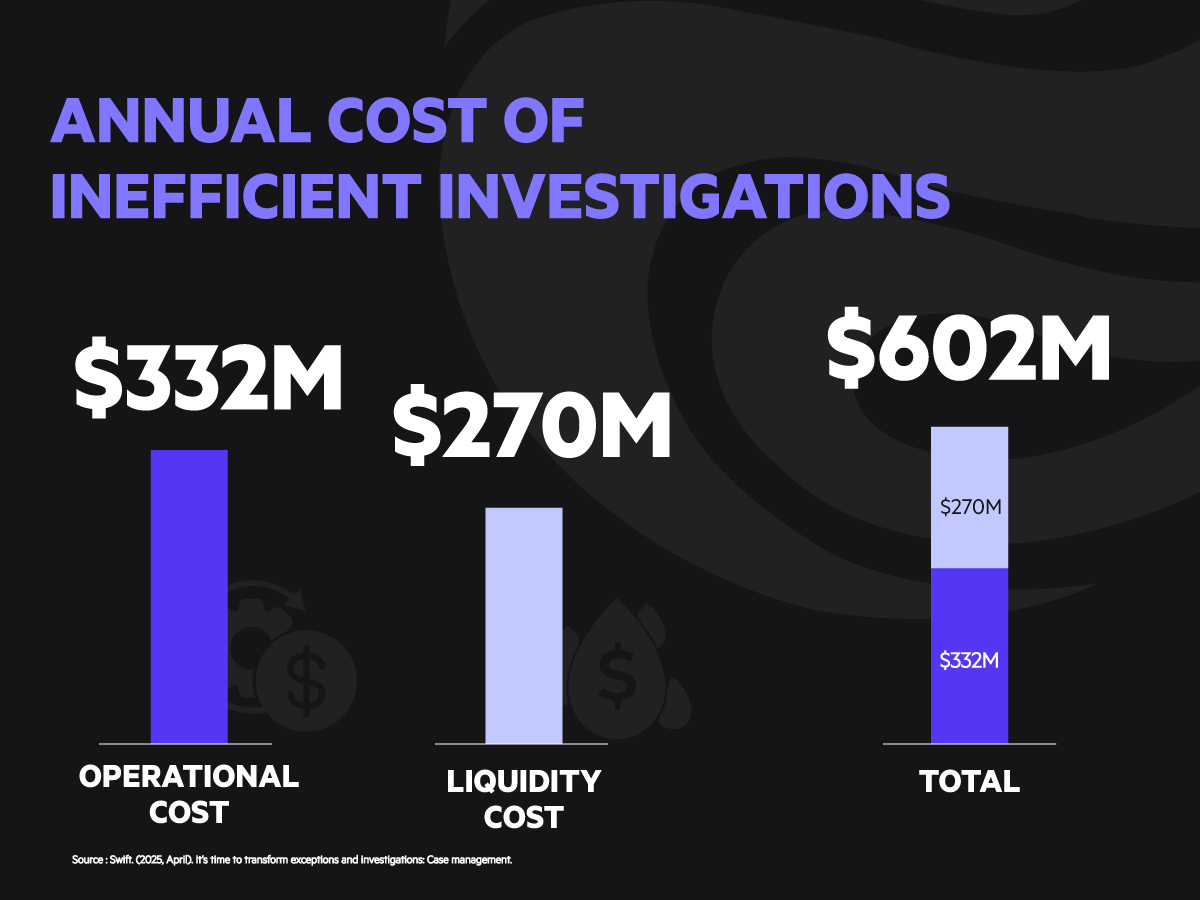

The Cost of Inaction

The industry has clear evidence of what inefficient investigations cost. Swift research shows that banks lose both liquidity and operational capacity because investigations remain slow and fragmented.

For many banks today , the picture is even more precarious. A global institution may absorb twenty million dollars in inefficiency as a cost of doing business. A regional or mid sized bank does not have that luxury. With margins already compressed, a single compliance miss can expose the bank to fines in excess of one hundred million dollars, enough to wipe out annual profit.

Why the Risk is Uneven Across the Industry

Global banks can afford enterprise scale investigations platforms. They can spend millions of dollars, dedicate large teams, and wait six to twelve months for a full rollout. For them, the return on investment eventually justifies the spend.

Mid tier banks do not have the same runway. They face the same regulatory deadlines, the same ISO 20022 migration, and the same Swift Case Manager requirements, but without the resources to absorb the cost.

At the same time, volumes are rising. Industry research projects a forty percent growth in payment volumes in the next five years. For mid-tier banks, that growth translates directly into rising case backlogs if investigations remain manual.

The risk is a squeeze from both sides. Compliance obligations grow heavier, customer expectations move faster, and operations teams are left without the tools to keep up. This is the gap, the missing middle, that Sibos conversations must confront.

What Good Looks Like

The answer is not to shrink an enterprise platform or bolt on more manual workarounds. What mid tier banks require is a right sized investigations solution, designed from the ground up to deliver speed, compliance, and transparency without the cost and weight of a global bank deployment.

A lighter solution should deliver four essentials:

- Automated case creation and duplicate detection so that every incoming Swift MT, MX, Fedwire ISO, or email inquiry is captured and structured from the start.

- Built in compliance checks and verification workflows that enforce four eyes and six eyes reviews, create an auditable trail, and satisfy regulators without adding more staff.

- Ready to use workflows and dashboards that provide investigators and managers with immediate visibility into queues, service levels, and productivity.

- Scalability by configuration so that a bank with ten investigators today can grow to two hundred tomorrow without reengineering the core process.

This vision is not speculative. Implementation experience shows that mid tier banks can be live in as little as six weeks when the rollout is configuration led rather than build heavy. That is a fraction of the time and cost of traditional enterprise implementations.

A Call to Action at Sibos

The challenges in investigations are not new, but the window for delay has closed. The global migration to ISO 20022 is well underway. Fedwire will require compliance by July 2025, and CHAPS will begin rejecting incorrect messages by November 2026. Corporates are already moving their flows to banks that offer structured data and faster resolution.

Research shows that banks which modernize investigations early can gain three to five percent in new revenue by capturing flows from competitors. That is the real prize: not just lower cost, but stronger client retention and market share growth.

For many banks, the call to action is sharper. You cannot absorb the cost of an enterprise deployment, and you cannot remain in manual investigations while cross border payments reach the end beneficiary in near real time. The market needs a practical investigation layer that fits your operating reality and can be stood up in weeks.

At Sibos, as the industry discusses the future of enterprise investigation suites and the expansion of Swift Case Management, the most important question is not only how global banks will adapt, but how mid tier banks will find their own path. Those that act now will protect compliance, preserve customer trust, and open the door to growth. Those that wait will be left behind.

A Challenge to Take Home from Sibos

Cross border payments now reach the end beneficiary in a day or less. Investigations still stretch into a week. That imbalance is no longer sustainable. It erodes margins, frustrates customers, and leaves banks facing compliance deadlines that arrive faster than their ability to respond.

The industry has invested billions to modernize payments. Now it must confront the unfinished business of modernizing investigations. The future belongs to banks that can deliver fast, transparent, and auditable case resolution at scale.

For mid tier institutions, the message from Sibos is simple: do not wait for an enterprise solution that was never designed for you. Demand a right sized investigations platform that can be live in weeks, not months, and built for the standards of today and tomorrow.

The missing middle is clear. The question is who will move first to fill it.