Banks are the backbone of economies, but often need help with inefficiencies and outdated processes. So, what is the solution? Pega Business Process Automation Services. For over 25 years, leading financial institutions have chosen Pegasystems for adapting to changing markets. Pega BPM is a leader in business process management and empowers banks to excel in customer satisfaction and operational efficiency. Pega BPA is the one-stop solution for banks to harmonize business goals with customer needs, ensuring success in a rapidly evolving landscape.

The Power of Business Process Automation Services in Banking

- Productivity and Satisfaction: BPA empowers bank agents and boosts their productivity and overall satisfaction. This reflects positively in customer interactions.

- Frictionless, Empathetic Service: BPA enables banks to deliver service with empathy, ensuring a delightful customer experience across various channels.

- Cost Reduction: Banks can significantly cut costs by implementing BPA, making operations efficient and effective.

- AI and Low Code: The use of AI and low code in BPA simplifies complex processes such as - dispute resolution, handling payment exceptions, managing fraud claims, and collections.

- End-to-End Transformation: BPA transforms the entire customer service journey, enhancing agent experiences and facilitating a digital service transformation across channels.

- Intelligent Automation: BPA automates consumer disputes, fraud claims, and commercial payment exceptions, improving efficiency, satisfaction, and compliance.

- Collections Enhancement: BPA accelerates collections while enhancing the customer experience. Personalized, empathetic service ensures compliance, reduces operational costs, and streamlines the collections process.

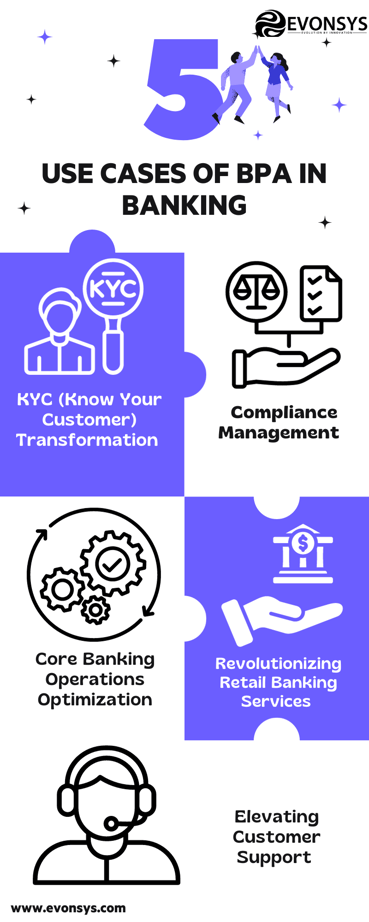

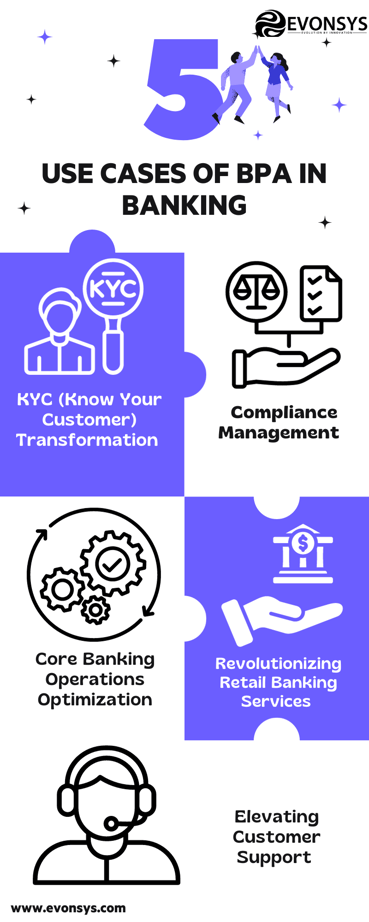

Top Use Cases of BPA in Banking

- KYC (Know Your Customer) Transformation

Business Process Automation examples include KYC Transformation in banking which means super-smooth onboarding. It's like a clear roadmap for clients and banks, offering total transparency. Plus, it handles global KYC risks with ease. Everything, from the first hello to managing documents, becomes easy. With BPA, ongoing monitoring is automatic, reliable, and worry-free. Handling complex client updates? No problem. Pega's got you covered with quick, transparent changes and clear accountability.

- Compliance Management

Think of BPA in banking as your assistant for compliance management. It helps banks understand customer risk better, making research easier and decisions smarter. BPA brings all the alert sources together, like AML, KYC, and fraud, onto one platform, making investigations efficient.

But here's the real deal: the Business Process Automation examples here use clever automation, AI, and machine learning to sort and prioritize alerts, reducing false alarms and improving the overall process. This personal assistant handles the practical details so investigators can focus on what really matters – results.

- Core Banking Operations Optimization

BPA is your banking efficiency tool, simplifying core operations. Business Process Automation services digitize and streamline everything from start to finish. It handles decisions, timelines, and priorities, boosting productivity and cutting costs.

With low code, you can meet business needs in a flash, automating tasks for swift progress. Scaling up is like a walk in the park with a centralized dashboard for quality and control. It's all about making banking operations smoother and more efficient, like music to your ears.

- Revolutionizing Retail Banking Services

One of the Business Process Automation examples is revolutionizing retail banking, which results in upgrading your financial superpowers. It enhances productivity, ensuring clients and staff have a smoother ride. Plus, it keeps the rulebook in check with ready-made features.

In the fast-changing world of payments, where exceptions, disputes, and fraud lurk, Pega's unified payment backbone is your go-to solution. It boosts efficiency, satisfaction, and compliance for every type of hiccup, now and in the future.

Imagine effortlessly resolving investigations and inquiries across any channel. Pega Smart Investigate is the cherry on the cake that keeps you in the loop with SWIFT messages, so you're always on top of things. And when it comes to disputes, Pega Smart Dispute brings it all together, ensuring a hassle-free journey from start to resolution. It's banking, but better.

- Elevating Customer Support

Any and every business thrives with an efficient customer support system in place? How does BPA fit into this? It turbocharges agent productivity, delivering smooth, empathetic service while reducing costs in every channel.

With AI and low code, it simplifies complex tasks like disputes, fraud, and collections. It transforms customer service from start to finish, making it agile and efficient. Even if you can't replace your current setup, Business Process Automation services optimize it with intelligent automation.

Collections become a walk in the park, engaging customers with personalized, empathetic service while ensuring compliance, and lowering costs. It's like having a customer support guardian angel on your side, making banking easier for everyone.

Conclusion

In the ever-evolving landscape of digital transformation, Business Process Automation services are a cornerstone for banks and financial institutions. To harness its full potential, partnering with a skilled and experienced collaborator is essential.

At EvonSys, we specialize in addressing the precise needs of the financial services sector. Our experts have played important roles in guiding numerous banks and financial organizations through successful digitization and automation initiatives.

If you are looking for a team with a proven track record in implementing successful business process automation, don't hesitate to reach out to EvonSys.